Financial Planning

Dec 01, 2023

Share Markets: A News Filter for You

A message from our Directors

What's in store for 2024...

When speaking to you; our clients, business associates and colleagues in recent months, the same message is being communicated... it's been a BIG year!

Although not quite at the finish line, 2023 has reinforced our belief that the most inspiring, impactful businesses in our industry are growing. Key takeaways and learnings, for the Cranage Group, were around our ability to adapt, both as individuals and a collective group within an ever-evolving business.

It can be both empowering and a little uncomfortable to think we are responsible for our success – and failures. Being willing to accept the consequences of our actions, choices or behaviours is not always easy, but as Paul Barrett (the CEO of AZ NGA) recently stated; ‘rather than get defensive, advice businesses should take the best practices from our past and present and build on them. ‘

Looking ahead to 2024, we remain committed to growth, thinking about future, observing trends and service excellence. We also remain committed to recruiting, training, and supporting the best people. Our team remains our greatest business asset, offering us the capacity to effectively service you, our valued clients, now and in the future. We are forever grateful to have such amazing staff and clients.

If we could offer one final piece of advice for the year, it would be this - don’t wait to grow! It's time to get excited about the future again.

Thank you for choosing us to be a part of your financial journey.

From our family to yours, Merry Christmas.

Ben, Sam & Laura Cranage

‘Now is no time to think of what you do not have. Think of what you can do with what there is.’ Earnest Hemingway

Economic and Market Observations

The much anticipated, 2024 Outlook

Directly from our new Investment Partner, Morningstar

As we stand at the threshold of 2024, it's essential we remind investors that the presence of uncertainty does not imply a scarcity of opportunities. Our approach to the year will be a blend of caution and optimism.

For those in Australia, and Asia Pacific more generally, the investment arena may appear daunting given recent market volatility. Yet we see investment opportunities emerging. Periods of market volatility and pessimism should not be seen as a barrier to investment but rather are a normal part of the journey to reach financial goals.

We know that 2024 will bring surprises for all investors, so rather than treat the future as if it is encoded in a crystal ball, we’ve focused this outlook on the wellbeing of the investor. We see positives in this environment, with opportunities to add value in fixed income and selected equity markets, among other ideas. By helping investors overcome whatever challenges the next year holds, it is our commitment to help you make sensible decisions that match the 2024 environment.

Key takeaways for 2024 Outlook;

The Key is a Robust Portfolio: Some of our favoured opportunities— including banks and emerging markets—can be cyclical. We size these exposures carefully and add offsets to create more robust outcomes.

Say Yes to Bonds: We like longer-term bonds more than have in a decade, but we are prepared for surprises, which is why alternatives and short-duration bonds still factor into our portfolio construction.

Risk Creates Opportunity: Increasing return prospects within fixed income make it a more compelling opportunity but select equity markets still offer more attractive returns.

Putting this together, it becomes clear that the key to successful investing lies in maintaining a long-term view, applying diligent risk management, cultivating solid savings habits, embracing fundamental change, and adopting a goal-oriented investment approach. With these guardrails in place, investors are well positioned to navigate the dynamically changing investment landscape and ensure that 2024 becomes a year in which they make meaningful progress towards their goals.

Click here to read full report.

Monthly Market Update

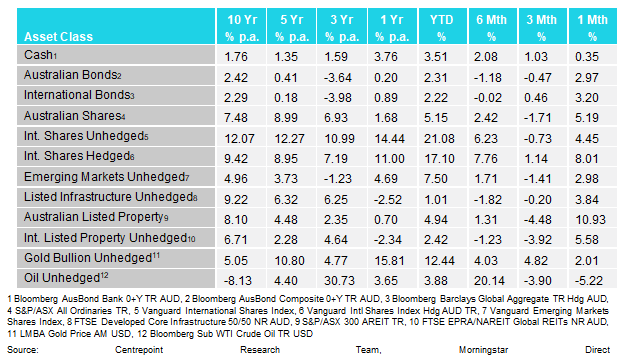

How the different asset classes have fared:

(As of 30 November 2023

Click here to read full report.

Morningstar Quarter-End Commentary, October 2023

An overview:

Both stocks and bonds fell over the quarter, as recessionary risks continue to loom, and yields continue marching higher.

Inflation and interest rates continue to dominate the market narrative, with “higher for longer” now the consensus.

Longer-term performance is still positive, demonstrating the value of taking a long-term view and patience when investing.

Click here to read full report.

Disclaimer

The information contained in this newsletter is of a general nature only and does not take into account your particular objectives, financial situation or needs. You should therefore consider the appropriateness of the advice for your situation before acting on it. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this publication. This newsletter is a publication of CFG Advice Pty Ltd (AFSL 501857), While all care has been taken in the preparation of this newsletter, to the maximum extent permitted by law, no warranty is given in respect of the information provided and accordingly, CFG Advice and our employees shall be liable for any loss suffered arising from reliance on this information.

Financial Planning

Dec 01, 2023

More Latest News

Subscribe to

the Latest News

Complete the details and you’ll receive monthly updates.

Book a complimentary discovery session to explore how we can achieve your goals and build your wealth.

Book a discovery session